notVC Playbook

Welcome to NotVC Playbook, the space where we take a deeper look at our functioning and operational process.

Introduction

This is an evolving document designed to convey the most up-to-date information regarding the notVC Operations. Due to the nature of notVC, an investment vehicle that needs to surface and maintain the pace of innovations, it is possible that it may not always reflect the most recent developments or decisions.

For the latest updates and to participate in the conversation, please be sure to visit the notVC Telegram channel. With that disclaimer over, enjoy!

About notVC

notVC is a tokenized (NFT) fund articulated by advisors and creators that come together to support and empower entrepreneurs in building the future web3 decentralized economy.

We are a collaboratively-owned investment vehicle that funds community-led and social token projects, as well as the tools and infrastructure that support them. We see ourselves as community enhancers with the mission of empowering growth in the creator economy.

The notVC token will be issued once the fund is fully committed. Tokens will be airdropped to all our members’ wallets, reflecting their voting rights, fund % participation, and other perks based on their investment size.

Members will be able to actively participate in notVC roadmap, investment, and operational decisions by utilizing their notVC Tokens over the snapshot platform.

The notVC funding and operations will be in stable coin (USDC) through the CirclePay platform, which will also serve as the default KYC validation platform.

What makes notVC different from other funds?

The fund is partially governed as a Decentralized Autonomous Organization (DAO). This DAO structure democratizes the decision-making process of some areas of the fund, creating a favorable means of investing.

All DAO participants receive a notVC NFT proportional to their share of the notVC investment vehicle, allowing them to vote on certain issues related to the fund's capital use, fund’s operation, etc.

By having both investors and advisors deeply involved in the blockchain venture community, this DAO structure will benefit from the wealth of the experience and networking they possess. Highly curated in this manner, the notVC fund clearly will stand out as an excellent funding prospect for new and up-and-coming Web3 projects.

Unlike most funds, notVC will have a liquidity program. Starting in year 1, new investors wanting to subscribe a participation in the fund will be able to communicate such intentions to the current investors and submit their proposals (more info on the below link).

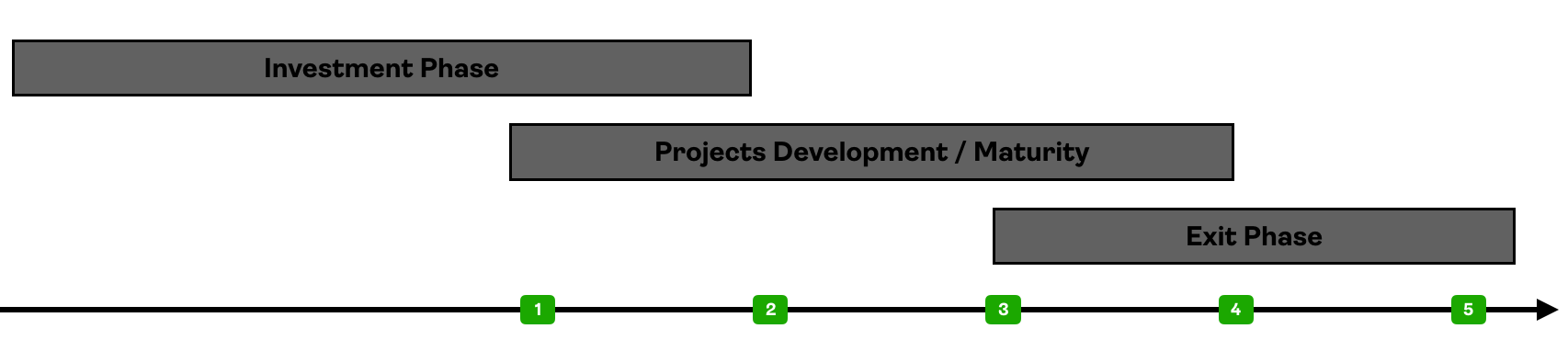

notVC LifeCicle

We expect to invest the capital of the fund in less than 2 years and plan our exits in less than 3 years after the investment period.

Assuming the current projects development speed and the continued growth over the blockchain industry, we envision a shorter exit phase than traditional funds, where notVC's positions may be able to partially liquidate some of the companies/project equity/tokens.

Vision

We believe that the current wave of blockchain-based applications will introduce cryptocurrency more broadly, and reduce friction to millions of new participants in the space. The notVC is designed to invest in the most dedicated group of entrepreneurs best able to support this vision of the future; a future in which DAOs and community tokens will achieve a prominence that outweighs even that obtained by the likes of NFTs and decentralized Finance during recent years.

At a closer look, notVC will seek to invest in cryptographic infrastructure and the ecosystem that rests on top of it, such as the tokenization of agriculture economies, Real Estate, or D-ID (Decentralized Identity ecosystems). We strive to be pillars of the application layers (Layers 2 and 3) by leveraging the groundwork that has been set at the framework level (Layers 0, 1, and 1.5).

Investors Links

📩 Whitelisting Form

Start-Up Links

📩 Application Form